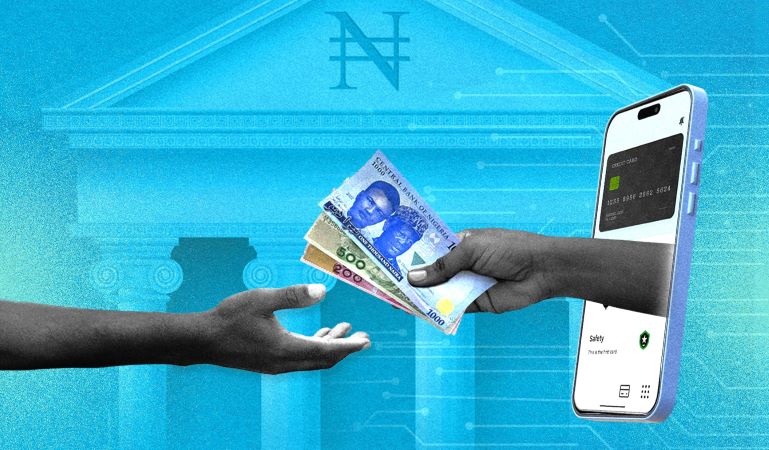

The Federal Competition and Consumer Protection Commission (FCCPC) has announced its intention to develop a new regulatory framework to address the increasing reliance of Nigerians on digital money lenders, commonly known as loan apps.

Mr. Babatunde Irukera, the CEO of the Commission, revealed the plan on a TVC live program on Monday, highlighting the rising issue of debt to digital money lenders (DMLs).

While the FCCPC has successfully reduced abuse and harassment by lending apps, Irukera expressed concern over the growing problem of loan defaults among Nigerians borrowing from these platforms.

He emphasized the need for a more sensible way of loan recovery that avoids unethical practices.

Related News: CBN Suspends New Loan Applications in Development Finance Program

According to Irukera, addressing this issue is crucial to the survival of digital lenders, who play essential roles in the economy.

The CEO acknowledged that the Commission had observed a significant level of loan defaults, and he stressed the importance of finding a balanced approach to responsible borrowing and lending.

He mentioned that regulations to be implemented in 2024 would take a broader perspective on these issues.

Irukera expressed optimism about creating a centralized credit system in the future, allowing reporting on individuals’ fiscal responsibility or creditworthiness.

He emphasized the need for a systemic strategy that inhibits people from obtaining credit irresponsibly.

The FCCPC has registered over 200 loan apps under its interim regulatory framework, which aims to curb unethical practices by ending the defamation and harassment of borrowers.

Irukera highlighted the success of the interim framework in reducing harassment and libelous messages by 80%, with ongoing efforts to address the remaining 20%.

The CEO acknowledged the evolving nature of the fintech industry worldwide and emphasized the importance of learning from the digital lending industry’s operations to establish the optimal regulatory environment.

As part of its commitment to cleaning up the digital lending business, the FCCPC continues to work on refining regulations to ensure responsible lending practices and protect consumers from harassment and abuse by loan apps.

You can also read: Dogara Advocates Inclusion of Private University Students in Students’ Loan Scheme